New York Times on "Design That Solves Problems for the World's Poor."

May 30, 2007

British adventurer Lewis Gordon Pugh is campaigning for climate change solutions and against growing CO2 emissions by attempting to be the first person to swim in the North Pole.

On July 15, Mr Pugh plans to swim a 1 km stretch in the -1.8C polar water wearing only goggles, a swimcap and speedos. This has never been done before, because the water used to remain frozen throughout the year.

More on the thrill seeking and obviously warm-blooded Mr Pugh here.

Posted by

TCP

at

30.5.07

0

comments

![]()

Labels: Climate Change, Climate Change Solutions

May 27, 2007

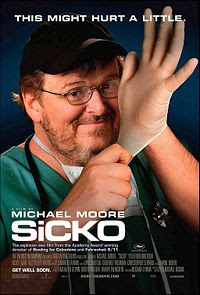

Michael Moore and Blogger's Confessions (Usher Style) Michael Moore's new movie "Sicko" about the American healthcare industry premieres in Europe in the fall. If you're traveling to the US this summer, you could to catch it as early as June 29.

Michael Moore's new movie "Sicko" about the American healthcare industry premieres in Europe in the fall. If you're traveling to the US this summer, you could to catch it as early as June 29.

Here's another story about Moore you might not have heard.

Now...

"These are my confessions

Just when I thought I said all I could say

My resume shows I got to get /

one more thing out of the way

Even though this blog may occasionally make me as a blogger sound green, social justice oriented etc., that's really not the whole picture. My history includes a stint in a New York investment banking team that did deals with managed care organizations, the same firms and CEOs that Moore attacks in "Sicko." Honestly, I have to be the one of the only Net Impact members in the universe that gets totally worked up while reading about Darfur or watching a movie about Edith Piaf who's also worked for a company providing military avionics and another that pitches managed care mergers. Talk about a split personality. There are no other major skeletons in the closet, though.

Okay, fine. There were those board memberships at Talisman Energy, Halliburton, and TJ Group.

In a sense, the reason these issues get me so fired up is having been there and seen some of this stuff up close. Many guys did not leave the office on 9/11 even despite bomb alerts at Grand Central because "defense companies are going to be on fire, man." (...? - Honey, look at me. I have ovaries. And a womb. And I'm wearing a skirt. I know that's rare here unless you're a secretary, but do I look like a man?)

Senior managers talked passionately about raw material prices, life insurance trends and yield curves without mentioning the dead in the city. There was callousness on a level I'd never seen before. It changed my life. As far as managed care goes, even not having seen more than a trailer for "Sicko", it's pretty clear to me Moore is doing the right thing and chosen to raise awareness about an urgent issue. Mr Moore may get a lot of criticism, but looking at it from both sides of the fence, I absolutely know which side I'm on and strongly believe Mr Moore is on the side of the people for whom the healthcare industry exists in the first place: patients, not shareholders. This was one of the deals done by the group that employed me. (It's old news now in fast-changing managed care. Trigon was bought by WellPoint.) Now, I could say I had no idea what I was getting into (that would be true), I could claim I was assigned to that group (sort of not true, I had befriended a colleague who I still keep in touch with), I could say that I had no choice (yeah, right), but I guess I can't. For a time, I wanted to see Wall Street. Also, I'm from Finland. Most Finns have no idea what American healthcare insurers do or how the system works. "Keeping administrative costs down and keeping health plans competitive" sounded good to me. Besides, my employer's health insurer wasn't hurting me in any way, so there were no negative personal experiences whatsoever. In fact, the bank even paid for everyone's Lasik surgery, worth (if memory serves correctly) about $12,000 each. (When the market melted, they stopped this practice though.) Anyway, at the time the bank had probably the best combination of healthcare plans any company anywhere could ever have. I, for one, am still thankful. Thanks to the bank's private health plan, I have 20/20 vision again.

This was one of the deals done by the group that employed me. (It's old news now in fast-changing managed care. Trigon was bought by WellPoint.) Now, I could say I had no idea what I was getting into (that would be true), I could claim I was assigned to that group (sort of not true, I had befriended a colleague who I still keep in touch with), I could say that I had no choice (yeah, right), but I guess I can't. For a time, I wanted to see Wall Street. Also, I'm from Finland. Most Finns have no idea what American healthcare insurers do or how the system works. "Keeping administrative costs down and keeping health plans competitive" sounded good to me. Besides, my employer's health insurer wasn't hurting me in any way, so there were no negative personal experiences whatsoever. In fact, the bank even paid for everyone's Lasik surgery, worth (if memory serves correctly) about $12,000 each. (When the market melted, they stopped this practice though.) Anyway, at the time the bank had probably the best combination of healthcare plans any company anywhere could ever have. I, for one, am still thankful. Thanks to the bank's private health plan, I have 20/20 vision again.

The job was no picnic, though, but that's a subject of a whole different confession (Usher didn't do Pt. 3, I just might.) I left New York and soon after befriended a New York ER doctor on my travels. We kept in touch. He told stories about people whose only healthcare providers were the emergency medicine doctors and nurses. It was interesting to start reading up on things. We talked about medical malpractice insurance (I had participated in a pitch for a nearly bankrupt med-mal business) and how a lot of doctors could no longer afford to practise because their insurance costs against potential lawsuits were prohibitively high - in the hundreds of thousands of dollars a year. There were over 40 million uninsured Americans. Doctors were being squeezed and bullied by insurers and outrageous litigation. Patients were being denied payments by insurance companies. It was quite incredible; as a Scandinavian, you easily take universal healthcare for granted. I began to realize that for the little while that I had spent as part of the American workforce, I had been part of an exclusive group of elite workers and as such, I had received elite benefits. Had I continued, I never would've seen anything different (of course assuming I would've kept ploughing ahead on that same road.) I would've thought everything was just fine.

And then it hit me: why did the financiers orchestrating healthcare mergers never talk about doctors, nurses or patients? Not once. It was as if we operated in a wholly separate universe.

The only answer that seemed in any way credible was that it really didn't matter to us. Nobody even pretended to care. Managed care corporate finance was a business where deals were done one step removed from the CEO who talks to lower level executives who talk to the claims experts who talk to doctors and patients and maximize corporate profit by denying treatments and reimbursements.

Of course, my former colleagues might laugh at this. I will never forget going to work one mid-week morning from the church. Now, I'm not religious, but sometime in my second year I started volunteering at a Park Avenue church homeless breakfast on my way to work. I didn't tell anyone at the office, I just went. So I got to work that one morning, and my colleagues were just hanging out, laughing. One joked to another, "Buddy, go feed the homeless or something."

I'd like to say this was the turning point that made me resign and change course. Not really. I left the city I love most in the world, but I still went back into finance for a while, unsure of what I wanted to do. Instead of Che Guevara badges and hemp clothing, I still wore heels and the damn pantyhose. I did a bunch of other things. But then I started working at a hospital.

And come to think of it, Che was a med student :) ...

Can't wait to see this movie.

Trailer:

Clip from the film:

Interview:

Posted by

TCP

at

27.5.07

0

comments

![]()

Labels: corporate responsibility, Corporations, films, human rights, Media, mergers and acquisitions, Public Health, wall street

May 26, 2007

Organic Food / Corporate Ownership

Cornucopia Institute, an organic food thinktank, links to a chart of corporate ownership of major (American) organic food producers. Some of these brands (Celestial Seasonings, Rice Dream, Ben & Jerry's, Kellogg's) are also available in Finland; you'll get a nice view of who owns what in this growing industry.

The chart is developed by Dr Phil Howard, a professor at Michigan State University.

Cornucopia Institute's blog is here.

Posted by

TCP

at

26.5.07

0

comments

![]()

May 22, 2007

A great article about Interface, the US carpet maker also featured in the film The Corporation, and its CEO Ray Anderson.

Look for the video feature for an interview with Anderson. The company e.g. recycles nylon thread, cardboard boxes, and carpet scraps, and powers production with methane from a local landfill.

Posted by

TCP

at

22.5.07

0

comments

![]()

Labels: corporate responsibility

May 15, 2007

Fundera också på vilken fisk ni äter...!

Överfiske i haven är tyvärr ett stort problem. Världsnaturfonden (WWF) har uppdaterat sin lista på fiskarter som man inte skall köpa p.g.a av att de är överfiskade eller hotade och därför håller på att försvinna ur haven.

Därför skall man helst inte köpa följande fiskarter:

- rödspätta

- svärdfisk

- torsk

- vildlax

- ål

- hälleflundra

- blåfenad tonfisk

- tropiska räkor

- marulk

- tunga

Kolla också senaste National Geographic som har en bra artikel om fiske och fiskbestånd som cover story.

Posted by

Dennis

at

15.5.07

0

comments

![]()

Kolla vad för trädslag möbler, golv m.m är gjorda av som ni köper!

Här ett exempel på vad man t.ex. inte skall köpa:

Det tropiska trädet merbau, eller kwila, kan försvinna helt som ett resultat av en ökad efterfrågan på lyxig heminredning i ädelträ. Det visar ”Merbau´s last stand”en ny Greenpeace-rapport. Rapporten visar att en stor andel av merbauprodukterna och timret från trädslaget merbau, som importeras till Kina för att sedan bli lyxiga golv och möbler, kommer från illegala avverkningar, skriver Greenpeace och hävdar att timret ofta smugglas "helt utanför myndigheternas kontroll".

Enligt den internationella naturvårdsunionen IUCN är risken för att merbauträdet utrotas mycket hög. Trots detta har merbau inte införts i det folkrättsliga CITES-avtalet, som reglerar den internationella handeln med utrotningshotade arter, skriver Greenpeace. Nya kartor publicerade av Greenpeace visar att 83 procent av de skogar där merbau fortfarande finns, kommer att stryka med på grund av avverkningstillstånd som har beviljats i området.

EU är också en viktig exportmarknad för merbau. Flera svenska företag importerar, enligt Greenpeace, merbau och merbauprodukter. - Efter att vi granskat den svenska trävarubranschen står det helt klart att den har väldigt svårt att själv se till att de tropiska träslag som används kommer från en hållbar och laglig källa. Därför måste nu regeringen sluta motarbeta EU-lagstiftning mot import av illegalt avverkat virke, säger Dima Litvinov, ansvarig för skogsfrågor på Greenpeace.

Posted by

Dennis

at

15.5.07

0

comments

![]()

May 13, 2007

Once more about Zimbabwe. So here's how the election process to chair the Committee on Sustainable Development actually works. The election was a secret ballot, and member states voted in blocks. According to the Guardian, the African states as well as other developing countries voted in favor of Zimbabwe 26 to 21 with three abstentions.

The Guardian writes, "Nhema, as a member of President Robert Mugabe's government, is the subject of an EU travel ban, meaning he cannot travel to Europe to meet ministers on commission business. Nhema responded by saying Western nations had the 'right to their opinions'. 'At the end of the day the majority rules as democracy does,' he said."

Oh, Zimbabwe - and Zimbabwean democracy.---

Speaking of democracy... (I don't know how to bridge this, but...) here is a killer YouTube clip from a few years back, where Emmy-winning comedian Jon Stewart goes on CNN to talk about democracy, politics and the media (this segment was aired in fall 2004). It is almost fifteen minutes long, but you might enjoy it. For those of who that don't know Jon Stewart, he's like the equivalent Peter Nyman. (For an explanation of "spin alley", click here.)

Posted by

TCP

at

13.5.07

2

comments

![]()

Labels: Media, Politics, sustainability, zimbabwe

May 12, 2007

This news week offers a nauseating main course. I'm going to have to start selectively targeting more positive news going forward, because this isn't working. It's not the news, it's me.

Well, in this case though, that's not true. It is the news.

Zimbabwe may become the chair of the UN committee on sustainable development.

Oh, Zimbabwe. The country with a 976.4% official inflation rate (as of 2006), 80% unemployment rate, 80% poverty rate, -4.4% GDP growth rate. Oh, Zimbabwe: transit point for cannabis, South Asian heroin, mandrax and metamphetamines. (That's from the CIA.) Oh, Zimbabwe: source, transit and destination country for women and children trafficked for forced labor and sexual slavery. Zimbabwe: where pimping is safer than politics.

Who cares about a UN committee, really? It is probably not going to be hugely important as far as practical global changes are concerned. But sustainable development? Did I miss something? Either this is some kind of a joke, or else it is a backhanded scheme to reign in on Robert Mugabe by doing this? That would seem like the only reasonable explanation for this, because otherwise this borders on the surreal.

Sadly, however, this kind of association with a dictatorial regime tarnishes not just the reputation of the United Nations, but the reputation of the entire concept of sustainable development. It is not right to misappropriate a concept and associate it with a place that is an antithesis of it. I really, really hope Zimbabwe doesn't actually get elected.

Maybe this is supposed to serve as a warning. Or, as another blogger said, given the economic collapse, at least Zimbabwe's "carbon footprint is admirable."

POSITIVE blog entries next week. I promise.

Posted by

TCP

at

12.5.07

0

comments

![]()

Labels: Politics, stupidity rules?, sustainability, un, zimbabwe

May 10, 2007

This semester we were asked by a finance instructor for tips on how to increase the number of women in her finance classes. She said that there is not a single woman in her class; all her finance MBAs are men.

This semester we were asked by a finance instructor for tips on how to increase the number of women in her finance classes. She said that there is not a single woman in her class; all her finance MBAs are men.Ethics is elemental (although this has nothing to do with gender.) Finance is often - and this is my personal opinion - taught in ways that purport it is value neutral; the quantitative aspect of it further reinforces this. The work is somewhat presented as pure and practical and free of ethical debates, when in fact so much of what gets done is none of those things. The systems thinking aspect of it is lost in the compartmentalization. Perhaps it is a grave oversimplification, but for some people being involved in, say, a defense deal, is going to feel like they're also indirectly involved in weapons production and its end results. Life isn't always simple, but if I invest in this, I'm going to feel like I'm profiting from this. If you didn't pitch that weapons manufacturer financing - if nobody pitched that deal - where would the resources come to expand production in that segment of the economy?

If you don't water the seeds, they won't grow into trees. And finance courses, in my (limited) experience, don't prepare you to tackle the ethics side of things. What do you do if you are assigned to a group that deals with the producer of WMDs? Many, many women and men alike find even the prospect of such a scenario extremely troublesome. I'll be the first to argue that to do so - to raise the issue of whether, say, financing a certain project or company is ethical - is still more often than not considered naive or self aggrandizing. Someone once accused me of having a big ego (and he may well be right, but it was nonetheless an accusation hard to refute without fueling the fire), when he praised Michael Milken in an introductory CoFi class, and I raised my hand to point out Mr Milken was in prison for insider trading. Likewise, back when it was still legal, I was wondering why banks were taking research analysts to pitches and roadshows. These are (or were) not, some argue, strictly speaking "finance" issues. But they deal with the foundations, the building blocks, the ethos of the field. If legal professionals or healthcare workers were accused of corruption, malpractice, and failure to follow their professional oath, we'd say something - and people do. So why can some other professionals hide under the guise of numbers and the detached middlemannish nature of the business?

What we do and how we do it matters, and it has consequences. You cannot throw a rock in the water and expect no ripples. But as a finance student you are rarely taught or encouraged to approach the value judgments you might have to make in the field of finance, when hundreds of millions of dollars or euros literally start to seem like peanuts and when a deal is supposed to be just a deal, no questions asked. I argue that finance students still aren't taught to engage eloquently and reasonably with the qualitative or ethical side of the subject, and when you think about it, you're sort of lost.

There are sustainable investment ventures, which is great. There are sustainability indexes, which is great too. This blog entry doesn't concern those; it concerns the mainstream aspects of the business, and why someone might be turned off. Many women as well as men are, I believe, turned off from the field of finance, because they sense the arrogance and the detachment from the rest of society. For an industry that sells the tenets of efficiency and change, there are many examples that suggest Wall Street professionals themselves are hardly welcoming of it.

You can't play fair, if people egregiously bend the rules decade after decade and get away with it. I'm not talking about bending the rules a little bit or cutting the corners a little bit. I'm talking about outright misconduct that appears to be obvious to anyone but the offender, who is like the emperor walking naked down Main Street, insisting his subjects compliment his attire. You can't instill the fairness mindset, if individuals who should set the standards abuse the system to their advantage. I have never understood why white collars and years of education make misconduct less reprehensible. You would think people with a higher education are better equipped to tell the difference between right and wrong, reasonable and unreasonable, acceptable and unacceptable. In answering the question, "how would we graduate more female finance MBAs", I would say, these issues must be addressed. How do you address them, especially if most people on the street think there's no problem? I have no idea. This is an issue that polarizes people, compartmentalizes them by class and gender, and easily alienates men from women even further. There's a huge issue there. It's not only about making the business woman friendly; it's about making it fair and ethical and transparent and open minded.

Posted by

TCP

at

10.5.07

0

comments

![]()

Labels: education, finance, gender issues, wall street, women, work

May 9, 2007

At the grocery store a half hour ago, the line was long enough for me to pull out the Wall Street Journal. On page 24 appeared a familiar face. It was Richard Grasso. Four years ago (now former) New York Stock Exchange chairman Dick Grasso received the highest pay package ever given to the head of a non-profit organization: 187.5 million dollars, consisting of a $139.5 million lump sum and a $48 million guarantee over the next four years.

At the grocery store a half hour ago, the line was long enough for me to pull out the Wall Street Journal. On page 24 appeared a familiar face. It was Richard Grasso. Four years ago (now former) New York Stock Exchange chairman Dick Grasso received the highest pay package ever given to the head of a non-profit organization: 187.5 million dollars, consisting of a $139.5 million lump sum and a $48 million guarantee over the next four years.

At the time when the Grasso case kept making the headlines, I was working in finance and had a very amicable and just boss, who sort of agreed with me - nobody, we genuinely felt, especially not the head of a non-profit organization, was worth $187.5 million. It wasn't just that we felt that Grasso's pay package seemed unreasonable. New York's not-for-profit corporation law explicitly states that officers only be paid a compensation that is "reasonable." Does $187.5 million sound reasonable? Not to me, and New York then-attorney general Eliot Spitzer didn't think so either; he sued Grasso. At that time, even though I'm not big on ultimatums, I half vowed to myself that if the courts ruled in Grasso's favor, I would never ever work in business again. It was almost too easy a vow to make, because I never thought the state would lose the case.

But in the world of high finance, apparently things are not that simple. Today, the WSJ and the NYT report that Mr Grasso has just won a key round in a ruling over his pay: the appellate court ruled that the AG "does not have to authority" to bring major parts of its case against Mr Grasso. Consequently, Dick Grasso may be able to keep the money after all. One hundred, eighty-seven and a half million dollars. Grasso has also sued the NYSE for another extra $50 million in compensation and for damages due to defamation after his departure from the NYSE in 2003. Might this have something to do with his legal fees, which some say have exceeded 100 million dollars?

"This lawsuit from my point is about honor", Mr Grasso said in January.

Now, I don't know how Dick Grasso defines honor, but some of us are not yet jaded enough not to find the Grasso case outrageous.

Not-for-profit corporate law states that officer pay should be "commensurate with services performed." Lumping all of Mr Grasso's compensation together and considering it his 2003 salary, consider that the average annual pay of, say, a family doctor in the US is $152,249. Nurses earn about $55,000 a year. Thus, Mr Grasso's pay implies that he is valued at the equivalent of 1,231 doctors or 3,409 nurses. Mr Grasso didn't diagnose cancer. Mr Grasso didn't perform dialysis or assist in heart surgery. Extending this further, Mr Grasso didn't found a company. He didn't even run a company. He didn't inherit a family business. He didn't invent a thing, anything. He was the head of a non-profit securities trading platform, bound by a law meant to limit pay to what is reasonable and commensurate with services performed.

The world is warming. 3,381 American military personnel have been killed in Iraq. 46.6 million Americans don't have health insurance. About 60 percent of 16-25 year-old Americans are functionally illiterate. And some guy can get paid a couple hundred million dollars for sitting in the office and taking clients to Le Bernardin.

I'm not sure what I'm advocating here, but people should really just do something, anything - perhaps start by switching off their television sets and participating in public discourse, because this isn't right. It's wrong on so many levels.

Posted by

TCP

at

9.5.07

![]()

Labels: corporate governance, executive compensation, finance, governance failures, greed, Moral Hazard, nyse, richard grasso, wall street

May 8, 2007

Who Owns Yoga?

Indians have begun a process of copyrighting traditional medicines and physical exercise in an effort to curb corporate efforts to claim title to yoga postures and other Indian traditions. Who owns yoga?

One of the owners mentioned in this article: Bikram Choudhury Yoga, Inc. More on Bikram and its legal battles here.

What about churches? According to this article, nearly all of American churches have incorporated as state (tax-exempt) corporations.

Faith and corporations make for a strange mix.

Posted by

TCP

at

8.5.07

2

comments

![]()

Labels: Corporations

May 7, 2007

At some point in the near future, maybe I will take some time to write possible counter arguments to some popular tenets against taking individual measures towards sustainability and (corporate) responsibility. Some of them are more serious than others; some are a bit on the informal side, but maybe you recognize a few. (For what it's worth, by writing these up I don't mean to make fun of anyone or be antagonistic. Some of these are merely arguments I've heard over the years.)

At some point in the near future, maybe I will take some time to write possible counter arguments to some popular tenets against taking individual measures towards sustainability and (corporate) responsibility. Some of them are more serious than others; some are a bit on the informal side, but maybe you recognize a few. (For what it's worth, by writing these up I don't mean to make fun of anyone or be antagonistic. Some of these are merely arguments I've heard over the years.)

- "That's nice, but I won't do it."

- "That's nice, but do you realize that what you do won't make any real difference in the world?"

- "Let me make it clear: I don't like it when someone tries to control how I spend my money and what I do."

- "You're not being realistic."

- "I want [fill in the blank]. I deserve it. I've worked hard for it, and I don't want anyone to come and tell me 'That's wrong.' How come it was right for [fill in the blank] to go ahead and do it ten years ago and now all of a sudden it's all wrong and unethical and whatever?"

- "I like to buy stuff. I'm not going to stop."

- "The world is going to ---- anyway, what's the use?"

- "I'm not interested. I don't care."

- "You're trying to make yourself feel better, but it doesn't make any real difference."

- "You're trying to make yourself feel better and make me feel worse, because I'm not doing this."

- "It's a fad. People who say these things sound like fundamentalists."

- "I don't believe in global warming. The ozone hole is not thinning anymore."

- "I don't like the Green Party. Some of them smoke pot."

- "It takes away from the bottom line, and we lose to competition."

- [Hmph.] "Just who do you think you are? (Huh?)"

- "Just enjoy life! Why are you that serious? It's just work."

- "Just relax. Better enjoy your life, because you only live once, and do you realize you'll be dead before you know it?"

Posted by

TCP

at

7.5.07

0

comments

![]()

Labels: corporate responsibility, futures, psychology, sustainability, vision

Businesses Try to Make Money and Save the World

ALTRUSHARE SECURITIES is a brokerage firm, engaged in the sort of things you might expect of a Wall Street outfit, like buying and selling stock, and providing research on companies. Unlike its peers, however, the firm is majority-owned by two charities that each control about one-third of it.

So is it a for-profit business? Or a nonprofit fund-raising machine?

In fact, like hundreds of new businesses starting up around the country, it is both. Altrushare is an example of the emerging convergence of for-profit money-making and nonprofit mission.

The practice is even creeping into corporate bluebloods like General Electric, whose $12 billion Ecomagination business promotes its products’ minimal environmental impact as well as their positive impact on the bottom line.

“We’re a for-profit institutional brokerage, and we have to compete on execution and commissions and do so with the same technology and talent you would expect from a top-tier firm,” said Peter Drasher, a founder of Altrushare, which is based in Bridgeport, Conn. “What makes us different is our nonprofit ownership and our mission, which is to support struggling communities with our profits.”

(continue reading here.)

Posted by

TCP

at

7.5.07

0

comments

![]()

Labels: corporate responsibility

May 5, 2007

Globe Hope visit on 23 April -- some pictures from the trip!

Posted by

TCP

at

5.5.07

0

comments

![]()

Labels: Net Impact Events

The IPCC 4th assessment part 3 "Mitigation" is out; you can find it here.

The voices of the UN scientists have never been stronger. The Guardian writes that the UN scientists warn time is running out and there are eight years to avoid the worst impacts of climate change. The Independent says that instead of panicking, people should act. The New York Times stays out of the prescriptive territory and notes that the climate panel has reached a consenses on the need to reduce harmful emissions.

Posted by

TCP

at

5.5.07

0

comments

![]()

Labels: Climate Change, Climate Change Solutions

May 3, 2007

Russia and Estonia

High time to reduce our oil dependency? After recent violent attacks in Tallinn and Moscow, Russia claims energy deliveries to Estonia may be cut due to "railroad repairs." HS reports.

Posted by

TCP

at

3.5.07

0

comments

![]()

May 1, 2007

Robert Greenwald's ("Walmart: The High Cost of Low Prices") earlier film "Outfoxed" about controversial American media outlet Fox News is available in full for viewing on Google Video.

Posted by

TCP

at

1.5.07

0

comments

![]()

Labels: corporate responsibility, Media, Robert Greenwald